Lessons from High-Profile Real Estate Sales: The Plaza Hotel

By Brady Thomas Rice

High-profile real estate transactions often involve intricate negotiations, legal hurdles, and fluctuating market conditions. The 2018 sale of New York’s iconic Plaza Hotel serves as a prime example of the challenges that arise when multiple stakeholders, regulatory constraints, and geopolitical factors intersect in a single deal. I have written this article in an attempt to shed light on the complexities of managing ownership disputes, foreign investment regulations, and valuation difficulties in a globally recognized property sale.

In 2012, the Indian business group Sahara India Pariwar acquired a 75% controlling stake in the hotel for $570 million. However, legal troubles faced by Sahara’s chairman, Subrata Roy, forced the company to sell its majority stake. Further complicating matters, the hotel’s management was overseen by a different corporation, Fairmont Hotels & Resorts, adding another layer of negotiations and operational considerations to the sale process.

The sale attracted a diverse pool of bidders, including Qatari royals, Chinese investors, New York real estate Families, and major U.S. real estate firms, such as JLL’s Hotels & Hospitality Group, which included myself, Brady T Rice, for a portion of the marketing process. Each potential buyer had distinct strategic interests in acquiring the property, ranging from expanding their luxury hotel portfolios to leveraging The Plaza’s brand value for international influence. However, strict U.S. regulations on foreign investments required extensive compliance checks, further lengthening and complicating the transaction.

Valuing The Plaza Hotel was another significant challenge. As an internationally renowned landmark, the property had few direct comparables in the market, making traditional valuation methods less effective. The ever-changing dynamics of the luxury hospitality sector added further uncertainty, requiring careful financial modeling and strategic forecasting. Despite these hurdles, the sale was finalized in 2018, with Katara Hospitality acquiring full ownership for $600 million.

This sale underscores several critical lessons for global real estate deals. Fragmented ownership structures can create significant delays, making early coordination among stakeholders essential. Legal and regulatory challenges must be identified and managed proactively to prevent complications that can derail negotiations. Geopolitical risks, including foreign investment restrictions and shifting economic policies, can heavily influence investor decisions. Lastly, valuing high-profile properties requires meticulous due diligence and an understanding of market trends beyond traditional metrics.

The sale of The Plaza Hotel highlights the multifaceted nature of international real estate transactions, where legal complexities, market uncertainties, and diverse investor interests must be carefully navigated. This case reinforces the importance of thorough due diligence, strategic negotiation, and risk mitigation in managing high-profile property deals. For investors and developers, understanding these challenges is key to successfully executing complex transactions in an increasingly globalized real estate market.

About Brady Thomas Rice

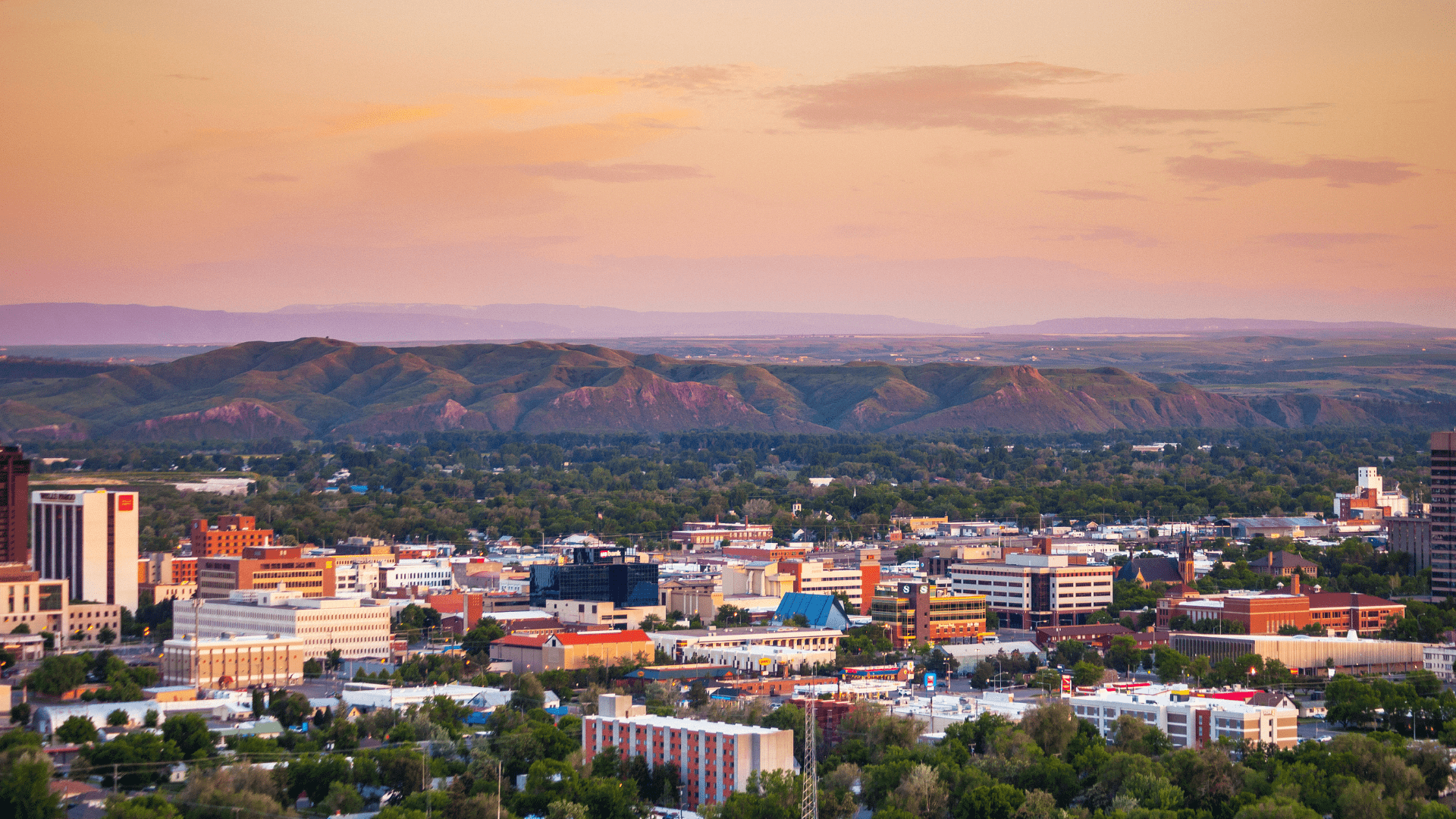

Brady Thomas Rice is the President and Founder of The BTR Group, Inc., a firm specializing in international executive management services focused on capitalizing, developing, restructuring, and operating commercial real estate assets in complex markets. With two decades of experience, Mr. Rice is a seasoned expert in the real estate industry. He is currently leading and advising on projects in multiple jurisdictions across the US Mountain West including Montana, Utah, and Colorado along with international destination markets including Baja California Sur, Mexico and Canada.