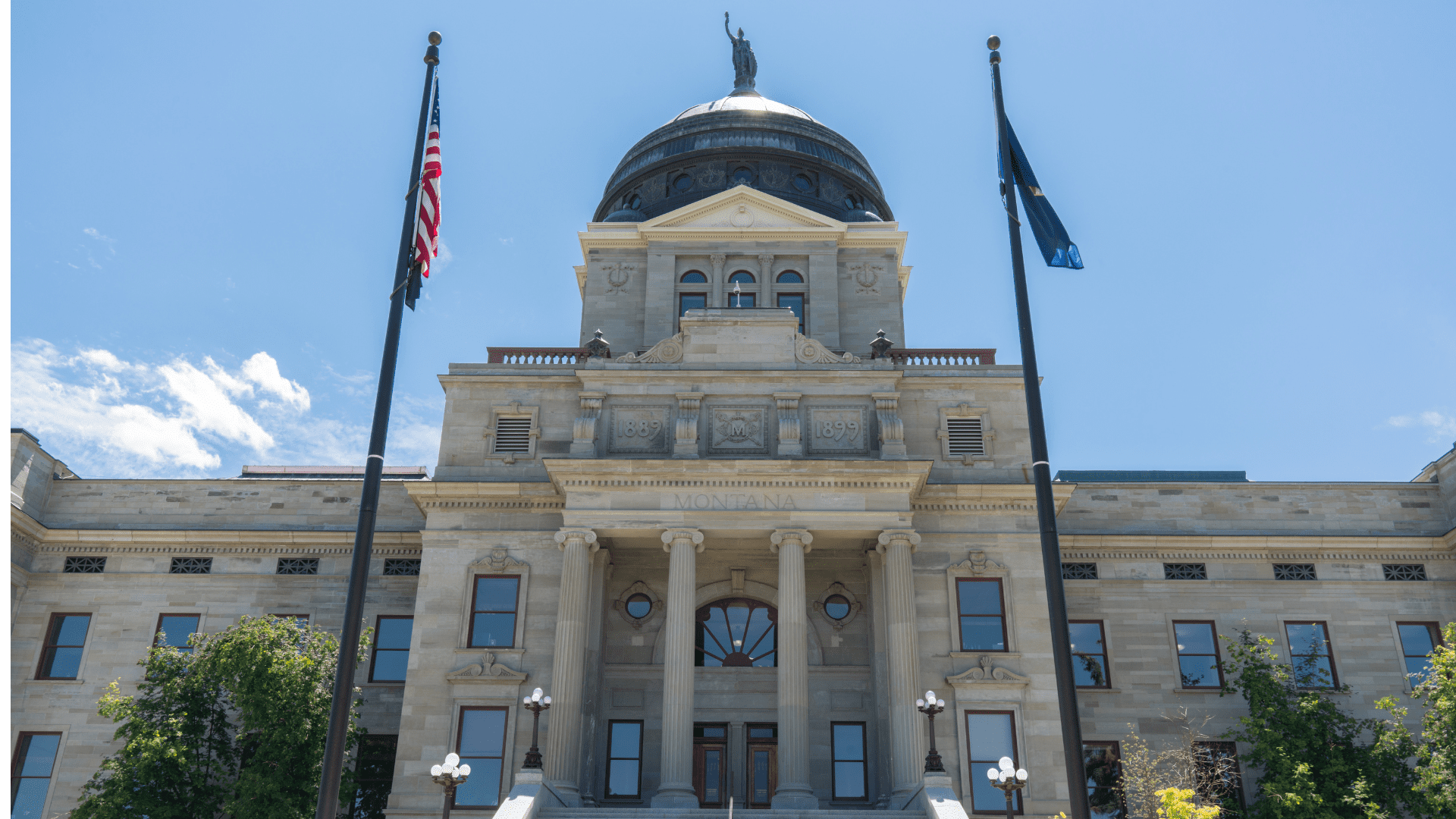

Montana Shelves Second Home Tax Bill, But the Discussion Isn’t Over

By Brady Thomas Rice

House Bill 231, a proposal to adjust property taxes by increasing rates on second homes while lowering them for primary residences and long-term rentals, has been shelved. The Senate Taxation Committee voted 5–3 to table the bill, pausing what has been a broader conversation about how to balance the state’s growing property tax burden.

Supporters of the bill viewed it as a way to ease costs for full-time residents, especially as home prices continue to rise across Montana. With a growing number of second homes owned by out-of-state residents, many felt it made sense to shift more of the financial responsibility to those who may not contribute through state income taxes.

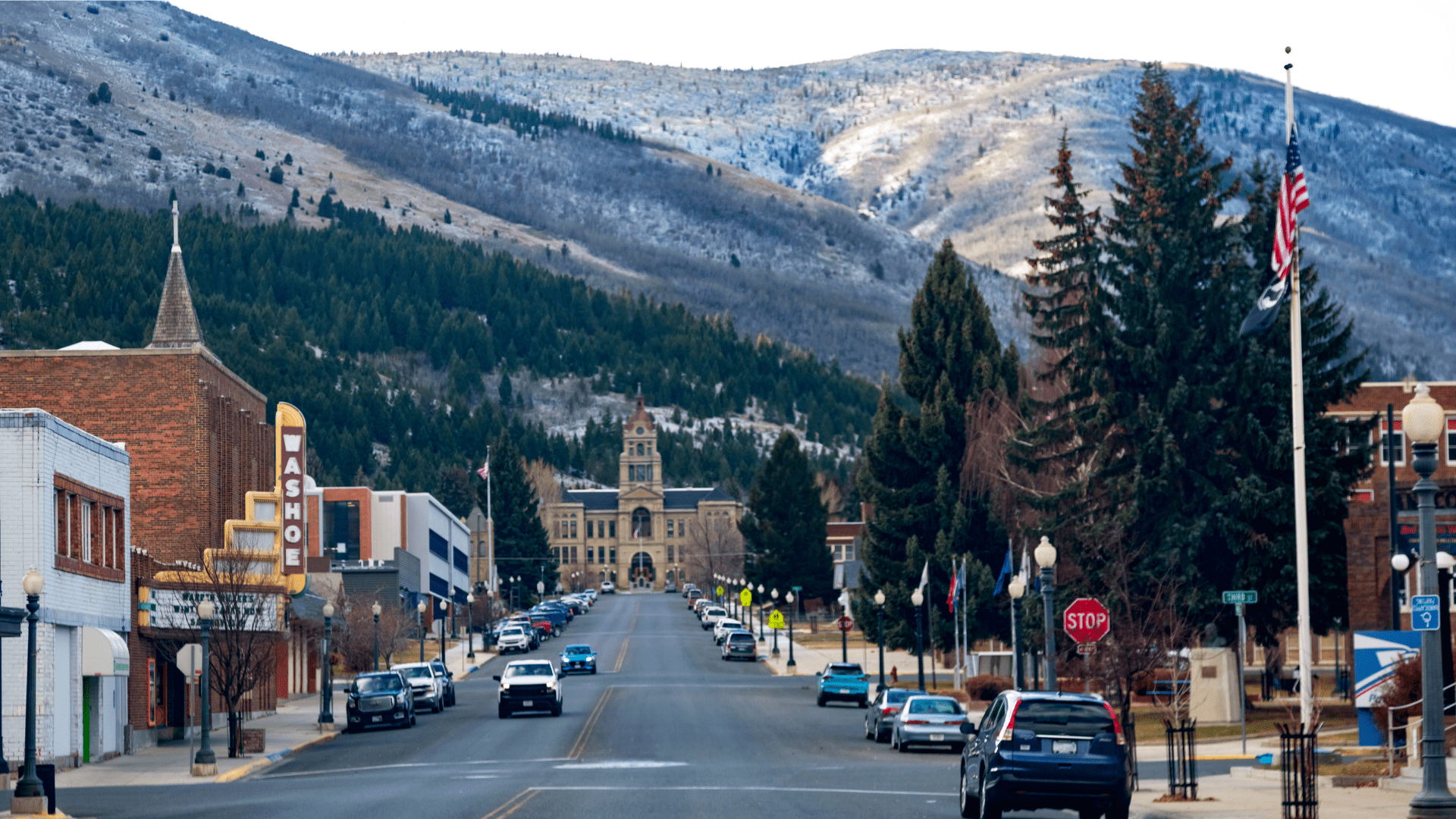

At the same time, others raised concerns about how the changes would play out locally. In cities like Billings and Sunburst, existing tax caps would have limited the ability to raise enough revenue from second-homeowners to offset reductions for primary residences. Some Montana residents who own second homes also felt the bill didn’t fairly account for those who already contribute to the tax base.

With HB 231 no longer moving forward, attention is now shifting to House Bill 528. This proposal takes a broader approach, offering property tax relief for residential, agricultural, and commercial properties, while increasing taxes on industrial properties. According to state analysts, that shift could result in a 24% increase for some industrial taxpayers.

The conversation about how to manage Montana’s tax system is ongoing. Rising housing values, changing demographics, and growing demand for public services mean these discussions will likely remain a central issue throughout the legislative session – and beyond.

About Brady Thomas Rice

Brady Thomas Rice is the President and Founder of The BTR Group, Inc., a firm specializing in international executive management services focused on capitalizing, developing, restructuring, and operating commercial real estate assets in complex markets. With two decades of experience, Mr. Rice is a seasoned expert in the real estate industry. He is currently leading and advising on projects in multiple jurisdictions across the US Mountain West including Montana, Utah, and Colorado along with international destination markets including Baja California Sur, Mexico and Canada.