Understanding the Challenges of Complex Real Estate Deals

By Brady Thomas Rice

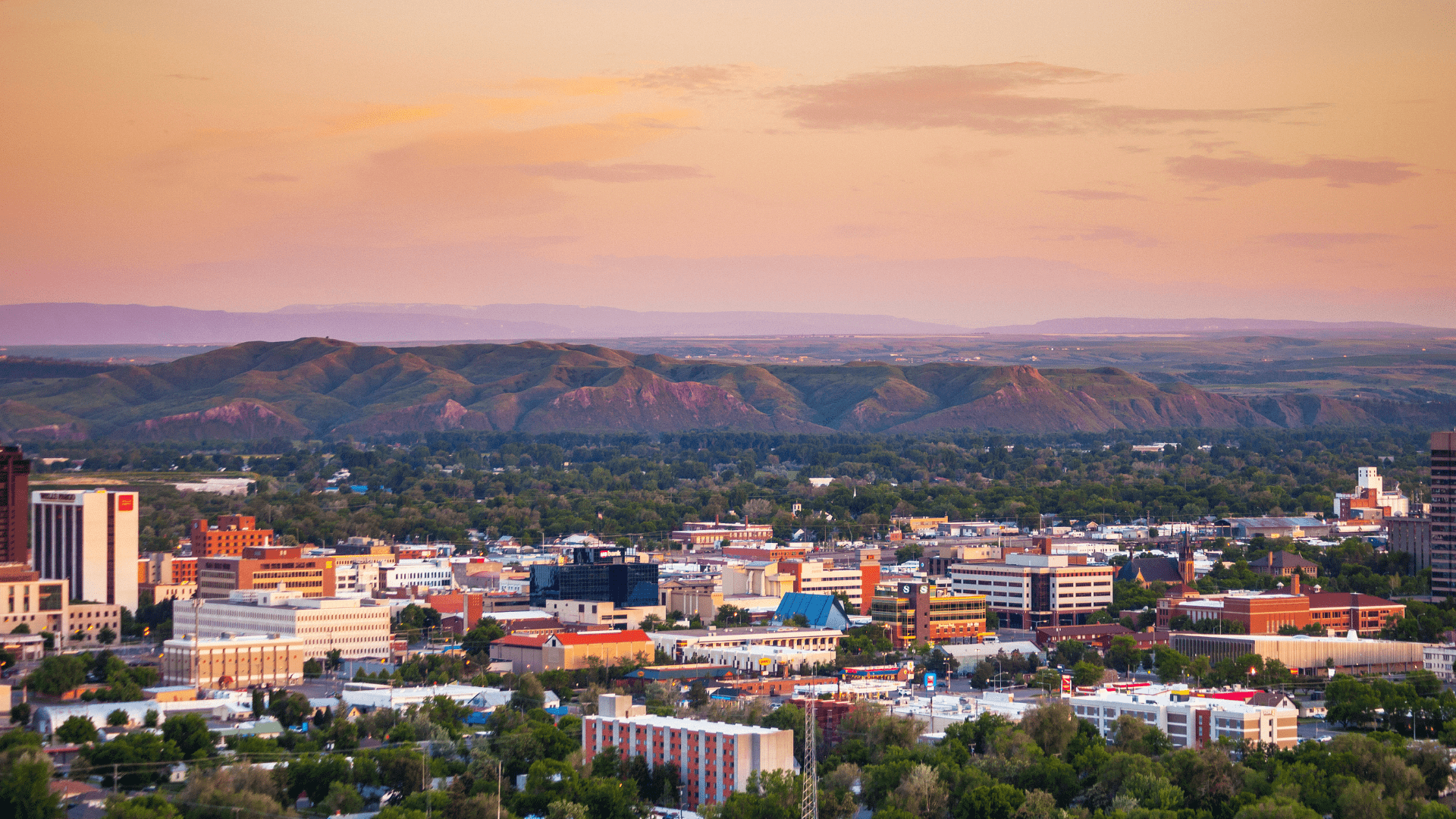

Picture a real estate deal that doesn’t just involve a single house or office building but an entire neighborhood—apartments, shopping centers, and office spaces all woven together. These large-scale projects, known as complex environment real estate deals, shape entire communities and economies. Unlike simple property sales, they often require extensive planning, multiple financing sources, and coordination between investors, government officials, and the public. This guide will help beginners understand what makes these deals complex, the challenges involved, and how to navigate them successfully.

While complex deals are riskier and more resource-intensive, the rewards can be significant. A successful project can attract new businesses, create jobs, and offer strong returns for those who financed it. However, due to their size and long timelines, these developments can also be more vulnerable to fluctuations in the real estate market, changes in local regulations, or shifts in public opinion. This is why developers and investors often rely on detailed research, flexible project strategies, and professional advice from lawyers, accountants, and urban planners.

Unlike a standard real estate transaction, where a buyer and seller may finalize their agreement in a few weeks, complex environment deals demand a more time-consuming and detailed approach. First, there is often a higher financial hurdle. Projects may cost millions—or even billions—of dollars, which leads investors and developers to seek multiple sources of funding. These can include traditional mortgages, loans from several banks or institutions, and equity from private or public investors.

Secondly, local rules on how the land can be used—or zoning regulations—can significantly affect what gets built. If the site is not already designated for the intended use, developers may have to petition the city council or zoning board to change the rules. In addition, environmental studies are frequently conducted to assess whether the project could harm local wildlife or water sources, which may require extra steps to mitigate any issues uncovered. This is especially relevant in areas such as Montana where real estate must co-exist with nature.

A third challenge revolves around stakeholder involvement. It’s not just about the buyer and seller; there may be community groups, local residents, government agencies, and other parties who have a say in how the project takes shape. Balancing everyone’s interests can be a lengthy process. Developers often hold public hearings, meet with local officials, or negotiate community benefit agreements (such as adding affordable housing units) to win support for their plans.

A straightforward property deal—like buying a single-family home—might require a few basic steps: price negotiation, a home inspection, and loan approval. Complex real estate deals add extra layers of due diligence, including analyzing soil conditions, hiring specialists to forecast future market conditions, and coordinating with local leaders on issues like traffic and public utilities. The length of time is also different: where a typical home purchase might close in a month, a large development could take years just to finalize the planning and financing before any construction begins.

Additionally, financial modeling plays a bigger role. Since a complex deal can take a long time to come together, investors and developers create projections showing different scenarios. They might ask, “What if interest rates go up?” or “Will the expected rental income still be there if the market slows down?” By creating multiple financial forecasts, they can plan for changes that occur over an extended timeline.

Successfully executing a complex real estate deal requires patience, expertise, and adaptability. These projects not only demand substantial financial investment and regulatory navigation but also require collaboration among multiple stakeholders. While the risks can be significant, the potential rewards—both financially and in terms of community impact—make them worthwhile endeavors for those who are well-prepared. By conducting thorough research, leveraging expert guidance, and remaining flexible in the face of challenges, investors and developers can turn ambitious visions into thriving, sustainable developments that shape the future of cities and economies.

About Brady Thomas Rice

Brady Thomas Rice is the President and Founder of The BTR Group, Inc., a firm specializing in international executive management services focused on capitalizing, developing, restructuring, and operating commercial real estate assets in complex markets. With two decades of experience, Mr. Rice is a seasoned expert in the real estate industry. He is currently leading and advising on projects in multiple jurisdictions across the US Mountain West including Montana, Utah, and Colorado along with international destination markets including Baja California Sur, Mexico and Canada.